The UAE real estate market is booming, but so are the risks. If you’re involved in property dealings, either as an agent, buyer, or investor, it’s critical to understand how financial crime regulations apply. With global watchdogs increasingly focusing on money laundering through real estate, anti-money laundering services in Dubai are more important than ever.

Why Is Real Estate a Target for Money Laundering?

Real estate offers a seemingly safe haven for illicit funds. Large transactions, limited transparency, and cash-heavy deals make it attractive to criminals looking to "clean" their money. In the UAE, high-value property markets combined with international interest have unfortunately created an environment ripe for exploitation.

To tackle this, regulators are now demanding stricter controls, and AML service providers are stepping up to help real estate stakeholders meet these obligations.

Your Risk Exposure as a Property Professional

Whether you're a broker, developer, or investor, you're part of the financial chain. Without proper AML protocols in place, you could unknowingly aid criminal activity and face serious penalties. Risk-based due diligence is no longer optional; it’s a regulatory requirement.

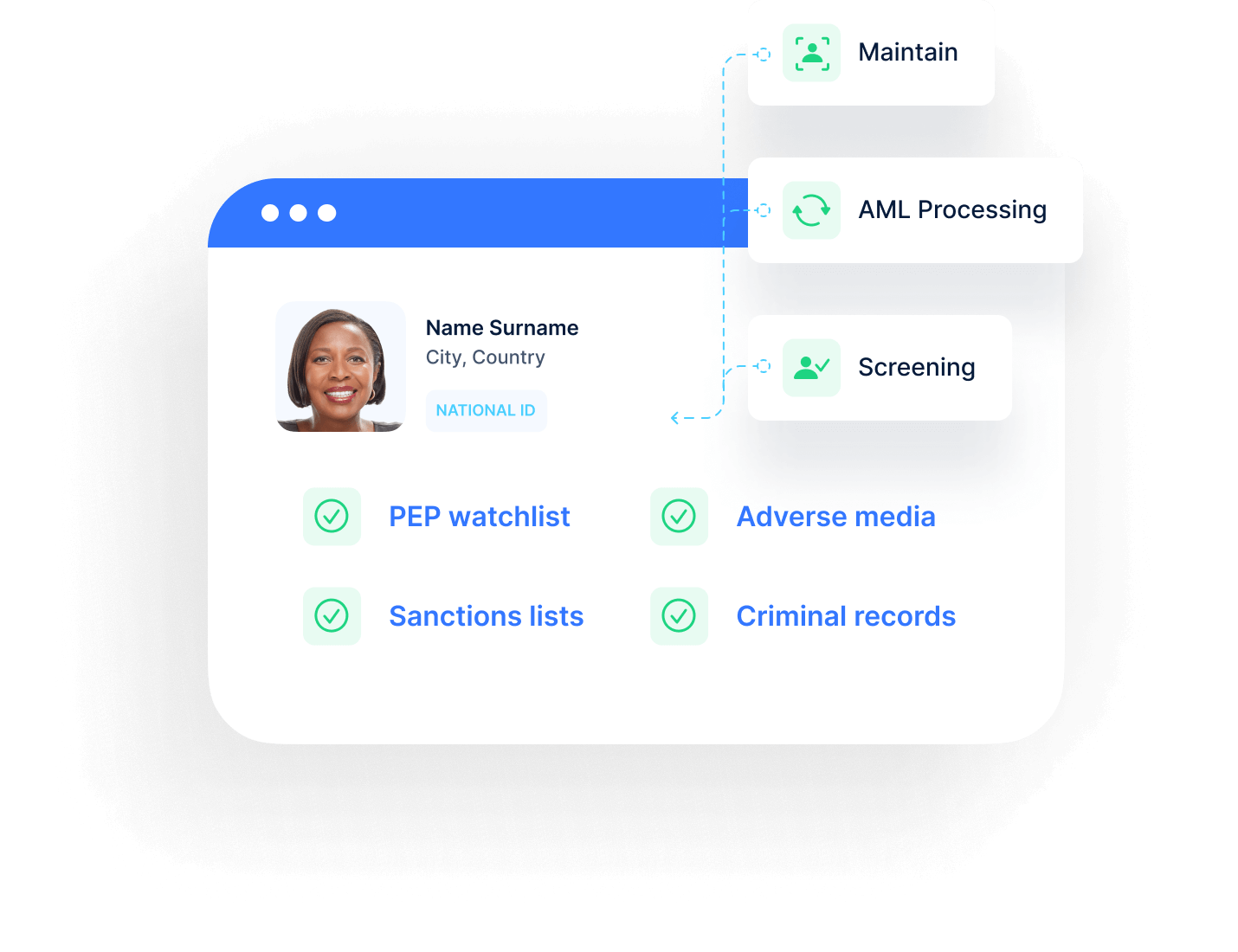

This is where advanced tools like adverse media screening KYC services play a vital role. These services automatically scan global news and sanctions lists to flag individuals or entities involved in suspicious activities, saving you from manual errors and potential liabilities.

What Should You Be Doing?

To stay compliant and safe, you need to:

-

Implement KYC Checks: Know your clients before entering a deal. Automated platforms can help you verify identity and the source of funds.

-

Use AML Monitoring Tools: Choose digital anti-money laundering services in Dubai that can adapt to your real estate workflow.

-

Stay Updated: AML laws in the UAE are evolving. Regular training and tech upgrades are key to staying compliant.

-

Report Suspicious Activity: If anything looks off, file a suspicious transaction report (STR) promptly.

AML isn’t just a box to check—it’s a shield that protects your reputation and business integrity.

Conclusion-The Way Forward

With authorities tightening oversight, the real estate industry must evolve. Smart digital platforms offering AML service providers and adverse media screening KYC services are no longer optional; they’re essential.

Failing to act could mean fines, licence loss, or worse. But taking the right steps now ensures you stay ahead of the curve and out of legal trouble, in the ever-watchful UAE real estate landscape.

#antimoneylaunderingservicesindubai #amlserviceproviders # adversemediascreeningkycservices

Comments on “UAE Real Estate Under Scrutiny: The Urgent Need for AML Screening”